Risk Management

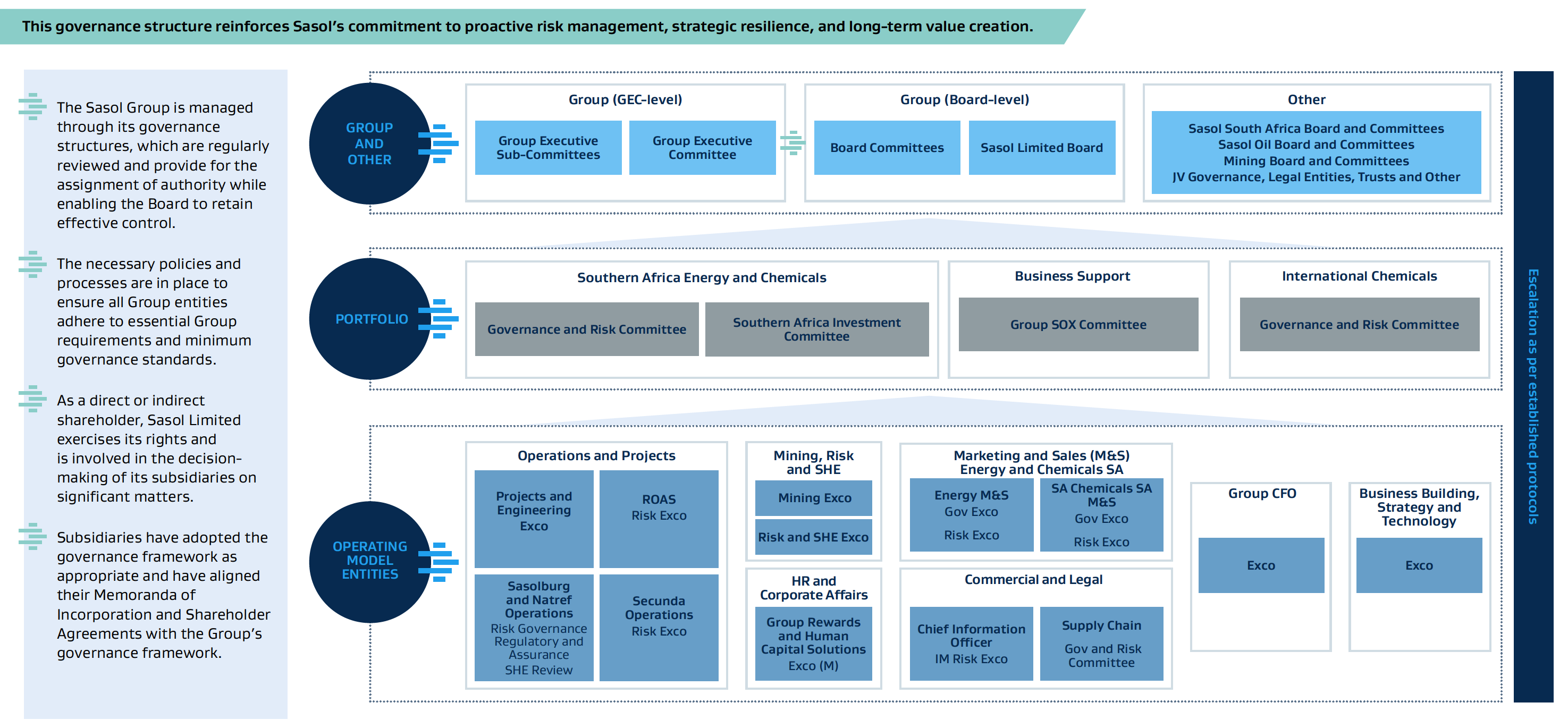

The Sasol Limited Board has the overall accountability for and oversight of risk management in the company and is supported by the Board Committees and the Group Executive Committee in this regard. The Group Executive Committee members are responsible for the management of risks in their areas of accountability, with delegated responsibility to and ownership of risks by their line managers. Our approach allows for key responses to be implemented as guided by the Board.

Risk management is further governed at different levels in the company with a focus on material risks, related key responses and assurance thereon, with a view to ultimately assure the Sasol Limited Board and the Boards of subsidiaries, where Sasol has the mandate to provide ERM support, on the adequacy and efficacy of risk management. We also communicate and report on relevant risks to external stakeholders in our annual suite of reports.

Responsibility for Sasol’s ERM framework and supporting processes resides with the SVP Risk and SHE who is responsible for enabling ERM and Combined Assurance across the company and ensuring that Sasol’s ERM framework is aligned to leading practice, governance and risk management frameworks and guidelines, including South Africa’s King Code for Corporate Governance, the Committee of Sponsoring Organisations’ Enterprise Risk Management Integrated Framework (2017) and the International Standards Organisation’s 31000:2018 Risk Management Guideline.

At Sasol, we apply an integrated risk governance model that embeds risk management into our strategic intent and execution. Oversight is driven by the Board of Directors, supported by Board Committees and the Group Executive Committee.

The Board holds ultimate accountability, ensuring alignment with Sasol’s ERM Framework and Combined Assurance Model (CAM). Its responsibilities include:

- Strategic risk oversight: Setting direction through our Risk Policy and defining Group financial risk appetite and tolerance metrics to support sustainable growth.

- Risk Management Effectiveness: Evaluating the adequacy and performance of risk processes aimed at proactive management of material risks, understanding health and status of our key responses and driving continuous improvement through improved risk maturity over time.

- Board Committees’ role: Overseeing assigned Group material risks and ensuring assurance mechanisms align with the CAM.

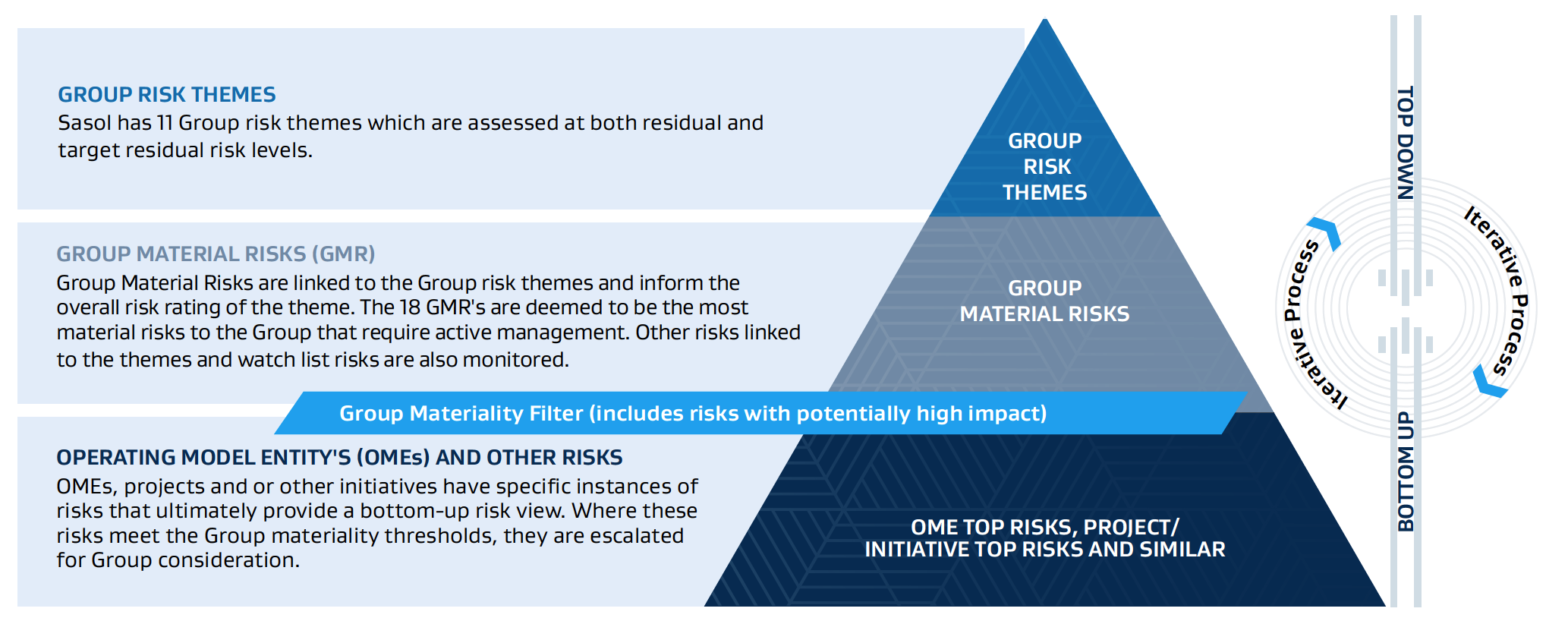

An iterative risk review process – allowing for both top-down and bottom-up risk updates and developments to ensure that the overall Group Material Risks reflect material areas of exposure.

At Sasol, we embed risk management into our strategic framework to support resilience, disciplined execution, and sustainable value delivery.

Our Group Material Risks (GMRs) are actively managed and reviewed in alignment with:

- Our Group ambition and purpose.

- Strategic objectives and value levers.

- Key priorities and performance metrics.

- Defined risk appetite and tolerance parameters.

We conduct an annual GMR review to assess key uncertainties across our operating environment, drawing on internal insights, external developments, and industry benchmarks. Our GMRs are structured around Group risk themes, which connect our strategy to sustainability outcomes and long-term stakeholder value. These themes are aligned to:

- Triple-bottom-line outcomes (People, Planet, Profit).

- Relevant Sustainable Development Goals (SDGs).

- Sasol’s Material Matters.

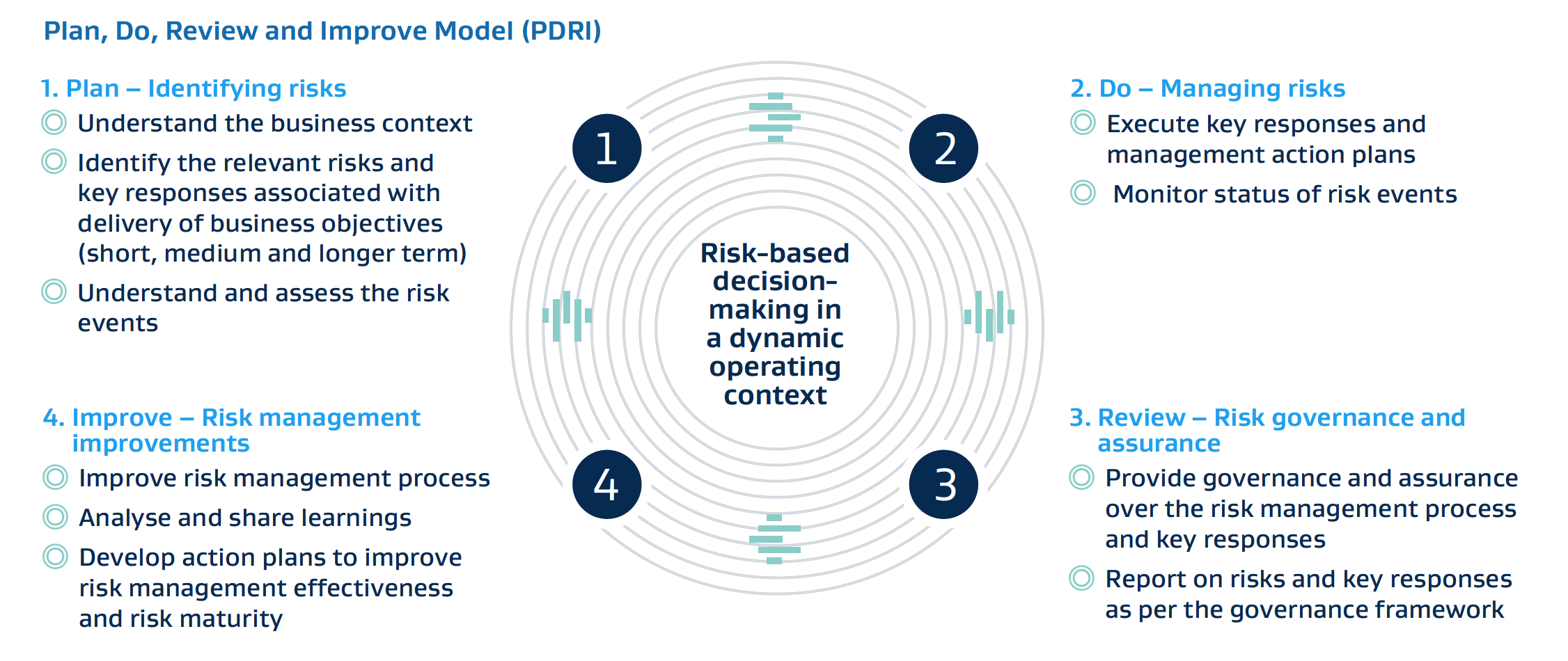

Across our business we apply a standardised, enterprise-wide process to identify, assess and respond to material risks, both strategic and performance-related, across short- medium- and long-term horizons. This enables risk-based decision-making in a dynamic operating context and supports Sasol’s strategy by proactively managing Group material risks that may impact current performance and future strategic ambitions. By managing risk we position the Company from a performance and strategic perspective to unlock future opportunities.

The annual review of the risk management process by the internal audit team, Sasol Assurance Services (SAS), underscores the importance of independent assessment and oversight in ensuring the effectiveness of risk management practices within the organisation. Such reviews are prioritised and approved by the Audit Committee. As part of their mandate, the internal audit team, led by the Chief Assurance Officer, conducts audits to evaluate the adequacy and effectiveness of various processes and controls across the organisation. SAS includes an annual audit of the risk management function and process. The review encompasses a comprehensive evaluation of the risk management framework, methodologies, policies, and procedures in place within the organisation. This includes assessing how risks are identified, assessed, prioritised, and mitigated across different business units and functions.

SAS operates independently from the risk management function to ensure unbiased assessments. Their findings and recommendations are based on objective analysis, aiming to provide an accurate assessment of the strengths and weaknesses of the risk management process. The insights and recommendations generated from the annual review serve as valuable input for enhancing our overall risk management capabilities. By identifying areas for improvement and implementing corrective actions, Sasol is able to strengthen its operational resilience and long-term viability.